The cannabis industry needs to be both “rational and rationalized” to gain investor support, Cramer said. As it stands today the market is neither, he said.

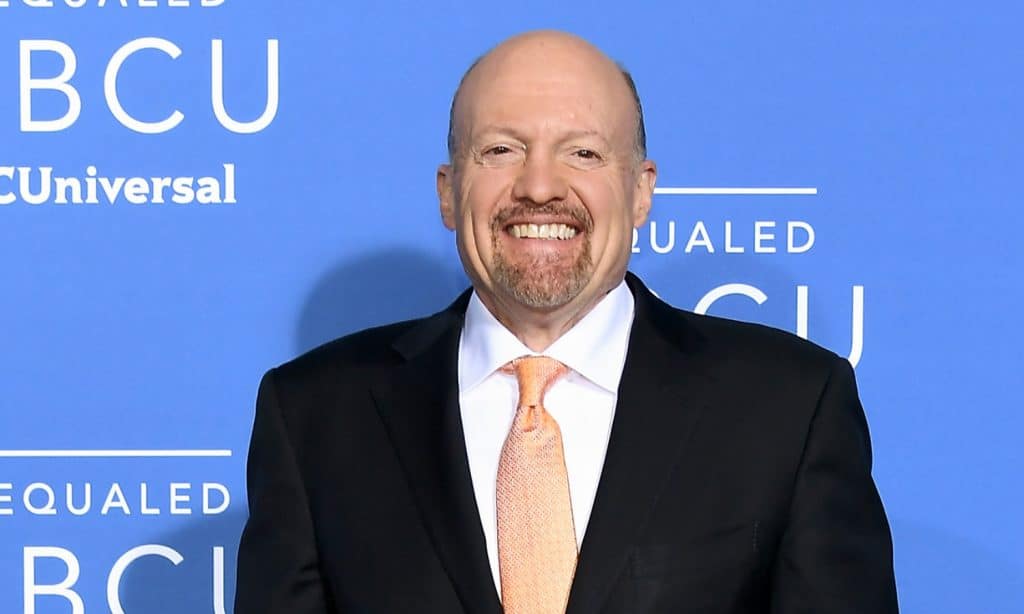

The cannabis sector no longer represents an “incredible opportunity” for investors, as the industry is “not what it was cracked up to be,” CNBC’s Jim Cramer said Thursday on “Mad Money.”

What Happened

The bullish case for the pot industry was based in part on the market’s small size and large potential to expand globally. But now that recreational legalization in Canada has played out for more than a year, the opportunity is “much smaller” than initially thought, Cramer said.

The legal cannabis market is seeing a combination of declining purchase prices and expanding production, he said.

RELATED: Here’s Why You Need To Be Careful If You’re Investing In Marijuana

The “equilibrium price for cannabis” is also lower than expected, which represents another “major change” for investors, the CNBC host said.

Why It’s Important

Pot stocks have lost much of their buzz, including a 50% drop in one of Cramer’s top picks, Canopy Growth Corp CGC 9.57%, since former CEO Bruce Linton was fired over the summer.

RELATED: ‘Fast Money’ Co-Host Tim Seymour Shares Tips To Invest In Marijuana Stocks

The Canadian market is “flooded” with too much marijuana, and the consumer can produce their own strains at home with minimal equipment, he said.

“The problems in the Canadian market are structural and they won’t be going away anytime soon.”

What’s Next

The cannabis industry needs to be both “rational and rationalized” to gain investor support, Cramer said. As it stands today the market is neither, he said.

For sentiment to improve, companies need to close, funding needs to “dry up” and mergers have to take place, the CNBC host said.

“Until then, these stocks are now sell-in-the-strength detritus,” Cramer said. “A casualty of a market not yet ready for prime time or anytime, for that matter.”