“All the states have huge potential. They just need to either pass medical cannabis laws or take their existing limited medical cannabis laws and expand them to allow patients to fully come into the markets,” said one top analyst.

By Adam Jackson

The South may be the last frontier for state cannabis legalization, but the region could be a boon for the industry once the floodgates open.

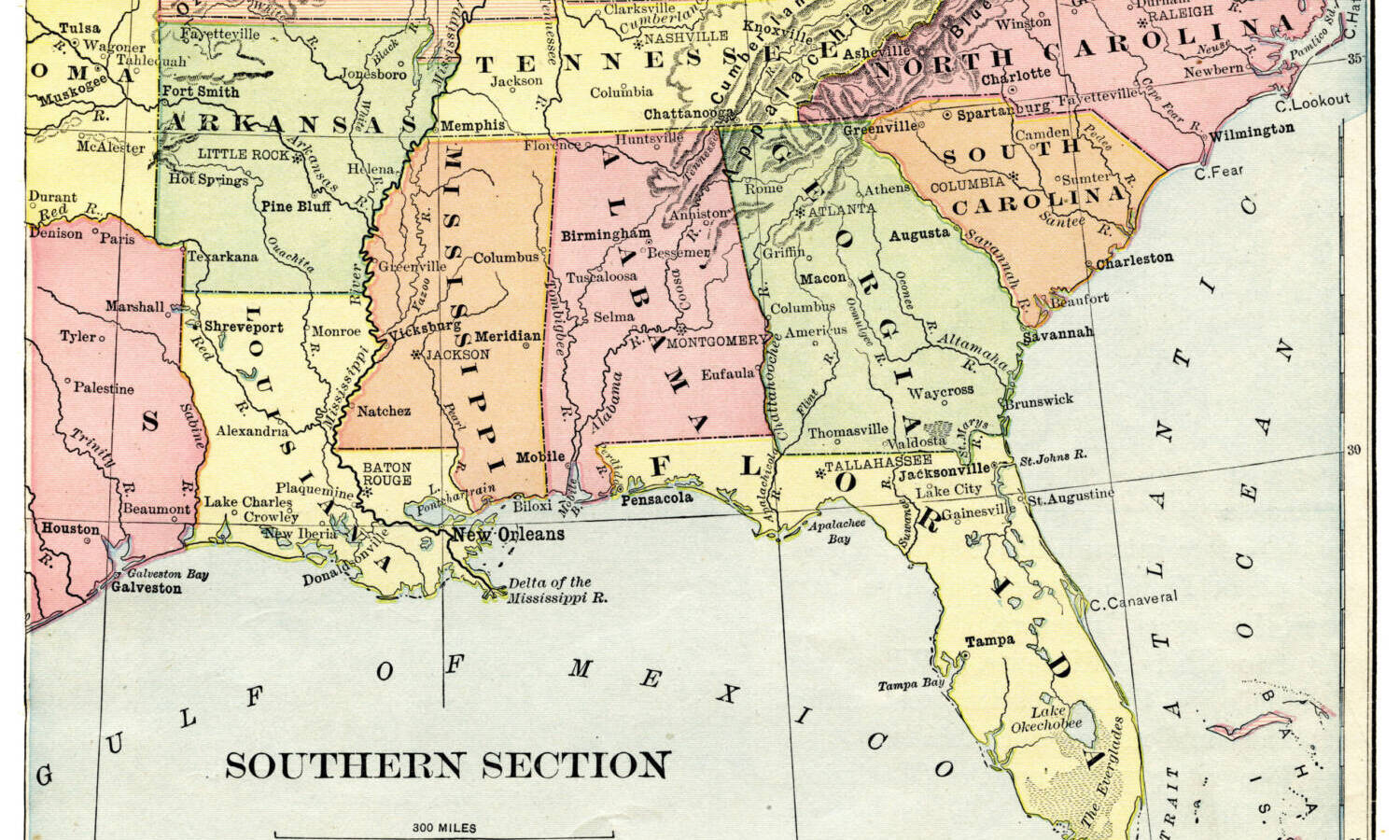

A report from cannabis consulting firm Global Go posits that Alabama, Georgia, Mississippi and Louisiana could provide value for entrepreneurs sitting on the sidelines of Florida’s limited vertical model — especially given Alabama’s approval of medical cannabis last May and further expansions in the other three state’s existing medical programs.

But the success has little to do with the “overall political leanings of (a state electorate),” said Tom Adams, principal analyst and CEO of Global Go and author of the report “Georgia, Alabama, Mississippi, and Louisiana: A Second Shot at Southern State Cannabis Profitability.”

Instead, it has “everything to do with how liberally medical programs are regulated,” he wrote. Factors for that include:

- Limits on types of products allowed.

- Qualified conditions approved.

- Rules for prescribing doctors.

- Store count limits and local opt-out rules.

“Politics absolutely matters, but it’s because it affects these factors that really determine how successful a market can be,” Adams told Green Market Report.

Access is key, in part because cannabis consumption is notoriously underreported. For example, more Oklahomans signed up for their state’s laissez-fair medical cannabis program than admitted to using the product in surveys conducted before legalization.

RELATED: Cannabis Industry Faces Sobering 2023

In Louisiana, participation in the medical program also ballooned after the legislature passed a law to allow more retail sale of flower.

However, the fact that Alabama, Georgia, and Louisiana do not have ballot initiative processes remains a critical issue. Adoption and expansion of the programs depend on the will of the state legislatures — and lobbying and educating elected social conservatives in the Bible Belt on the cannabis question has proved sluggish.

Growth Potential

“Still, even if the region only sees Missouri’s $33.08 per capita spending in 2021, just over half Florida’s level, the combined markets could grow quickly to nearly $800 million,” Adams wrote.

Andrew Livingston, director of economics and research for Denver-based cannabis law firm Vicente Sederberg LLP, noted that the word “potential” is key when it comes to speculating growth stories.

“All the states have huge potential,” he told Green Market Report. “They just need to either pass medical cannabis laws or take their existing limited medical cannabis laws and expand them to allow patients to fully come into the markets.”

Livingston noted that state-level medical cannabis laws help demonstrate the legitimacy of cannabis patients and business.

RELATED: This State Will Revisit Medical Cannabis Legalization Next Year

“That legitimacy changes the lives of voters at the state level and those state level voters put pressure on federal legislators to evolve and recognize,” he added.

He believes that Mississippi, which permits flower sales and does not cap the amount of licenses operators can hold, “will show over time the potential of a market that allows the patients to truly actualize their demand.”

Pressure from Florida

Despite tight Southern medical markets, the possibility that Florida will adopt adult-use consumption next year could open the floodgates for cross-border traffic and potentially persuade neighboring legislatures to open up their markets to capture that revenue for state coffers, Adams said.

“Because, boy, if Florida goes adult use, and anybody from Alabama, Mississippi, or Louisiana can go down there and get cannabis, that’s just money left on the table by the legislatures of those states,” he said.

“The big move will happen when Florida goes adult and and suddenly, there’s hundreds of millions of dollars in tax revenue at stake.”

This article originally appeared on Green Market Report and has been reposted with permission.