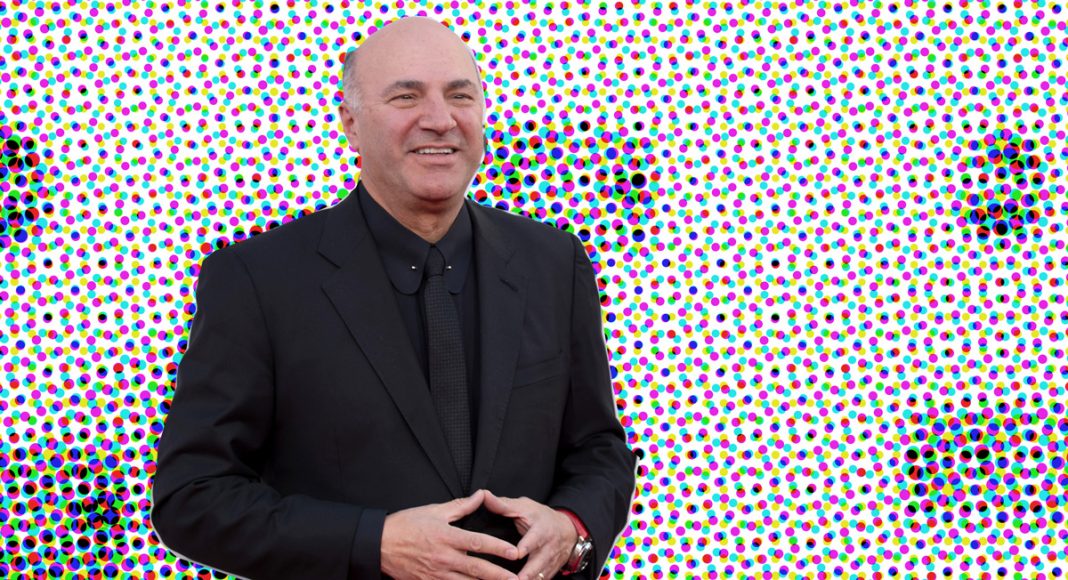

Canada legalized cannabis for adult use nationwide this week, and despite the fact that this huge industrialized nation took the leap, ‘Shark Tank’ host and Canadian businessman Kevin O’Leary, a.k.a. Mr. Wonderful, is beyond weary of investing in pot stocks.

“Never would I touch this. Never,” O’Leary said to Yahoo Finance when asked if he would not invest in cannabis unless it were fully legalized in the U.S. “When you invest in a Schedule I narcotic, you are at risk to breach the RICO statutes of aiding and abetting the transfer of a Schedule I narcotic across state lines.”

But is his paranoia warranted? He went on, “That is an extremely punitive place to get to. I am not going to look good after 26 years in prison, so the chance that I am going to invest in cannabis is zero.”

What O’Leary fears most is the scheduling of cannabis. Schedule I means that a substance is considered to have a high potential for abuse and contains no known medical value. The fact of the matter is that there have been too many studies on cannabis that prove its medicinal worth for the definition to hold water any longer. Prohibition is crumbling one state at a time with rumors of federal de or rescheduling around the corner.

Mere hours after O’Leary made his comments, Chris Walsh, founding editor and vice president of Marijuana Business Daily, said on Yahoo Finance’s Midday Movers: Retail investors have largely shrugged off legal concerns.

Investments in Canadian cannabis companies have grown at a rapid clip, and though some investors fear a balloon, it doesn’t seem like any of them, save Wonderful, are concerned about incarceration. That would be one helluva vast sweep of the investor class were the government to take action on stock purchasers.

O’Leary did say that he thought that if medical CBD were to be split into a different category that it would be “the big opportunity.” He went on to explain, “There’s a lot of interest around the world in using the molecule as a medicinal product away from the recreational product, which is always going to be controversial.”

It’s a limited vision and one that’s not likely to catch on, however, this article is not intended to advise anyone on how to invest in the stock market or otherwise, but to report on the interests of one investor and to touch briefly on his many counterparts.